Cryptocurrency trading is a fast-paced and ever-evolving landscape, fraught with market volatility that can leave traders vulnerable to significant losses. In this comprehensive guide, we will explore the concept of “crypto batter,” which encompasses the challenges faced by traders in the face of unpredictable price fluctuations.

We will delve into the intricacies of market volatility, discussing the contributing factors such as news cycles, whale manipulations, technical glitches, and market psychology. Understanding the emotional impact of market battering, including fear, FOMO, and frustration, is crucial in developing effective strategies to navigate the volatile crypto market.

Additionally, we will delve into the risks associated with unreliable exchanges, such as hacks, scams, and inadequate security measures, emphasizing the need for a “batter proof exchange” that prioritizes security, stability, and usability.

Furthermore, we will provide insights on how to choose the right development partner for building a secure platform and Pyramidions as an industry leader in constructing “batter proof exchanges.” As a Mobile App Development Company in Chennai, Pyramidions brings a wealth of expertise and experience in creating secure, user-friendly applications that meet the highest standards of quality and performance. Lastly, we will empower traders with actionable tips and valuable resources to confidently navigate crypto volatility. By following the guidelines and insights provided in this guide, traders can enhance their understanding of market dynamics, mitigate risks, and ultimately aspire to become masters of the crypto domain.

Understanding the Volatility Problem

Cryptocurrency markets are highly susceptible to volatility, experiencing significant price fluctuations driven by various factors. This volatility often leads to a phenomenon known as “crypto batter,” where traders face challenges stemming from unpredictable market movements.

Several factors contribute to crypto market volatility. News cycles, including regulatory announcements and major developments, can trigger significant price swings. Whale manipulations, where large cryptocurrency holders influence prices through substantial buys or sells, also play a role in amplifying volatility.

Technical glitches, such as trading platform outages or errors, can further contribute to sudden market movements. Additionally, market psychology, investor sentiments, and the fear of missing out (FOMO) can drive heightened levels of volatility.

The emotional impact of market battering cannot be underestimated. Traders often experience fear, anxiety, and frustration when prices fluctuate rapidly, leading to impulsive decision-making. These emotions can influence traders to buy at peak prices driven by FOMO or sell at lows due to fear, exacerbating potential losses.

The risks associated with unreliable exchanges add another layer of complexity to the volatility problem. Hacks, scams, and inadequate security measures can leave traders vulnerable to significant financial losses. It is crucial for traders to prioritize security and choose exchanges that implement robust security measures, including strong authentication protocols and frequent security audits.

In this section, we have explored the factors contributing to market volatility and the emotional impact of market battering. We have also highlighted the risks associated with unreliable exchanges. By understanding these aspects, traders can better prepare themselves for the challenges posed by market volatility and make informed decisions to navigate the crypto landscape.

In the subsequent sections, we will delve deeper into building a crypto batter proof exchange, choosing the right development partner, and empowering traders to thrive in the face of Crypto volatility.

Building a Crypto Batter Proof Exchange

A crypto batter-proof exchange serves as a stronghold for traders in the face of market volatility. It prioritizes three key components: security, stability, and usability.

- Security: is of paramount importance in a batter-proof exchange. Advanced encryption techniques, multi-signature wallets, and rigorous secure coding practices are implemented to protect traders’ funds and personal information. By employing robust security measures, exchanges can safeguard against potential threats and ensure the integrity of the platform.

- Stability: is another critical factor in a crypto batter-proof exchange. Robust infrastructure, effective liquidity management, and comprehensive disaster recovery plans are in place to ensure uninterrupted trading operations, even during times of extreme market volatility or unexpected events. By maintaining a stable and reliable platform, exchanges can instill confidence in traders and provide a seamless trading experience.

- Usability: is a crucial aspect that distinguishes a batter-proof exchange. An intuitive user interface, diverse trading tools, and responsive customer support are essential in creating a user-friendly environment. A crypto batter-proof exchange should empower traders with easy-to-use features that enable them to execute their strategies effectively and stay ahead in the dynamic crypto market.

In this section, we have emphasized the importance of building a crypto batter-proof exchange by focusing on security, stability, and usability. By prioritizing these components, exchanges can provide traders with a secure and reliable trading environment that enables them to navigate market volatility with confidence.

In the subsequent sections, we will explore the process of choosing the right development partner, and empowering traders with valuable insights to navigate the crypto market successfully.

Choosing the Right Crypto Exchange Development Partner

Selecting a reliable Crypto Exchange Development partner is crucial when building a crypto batter proof exchange. Various factors should be taken into account in the decision-making process.

- Firstly, the choice between custom development and White Label Exchange Development solutions needs to be evaluated. Custom development allows for tailoring the exchange to specific requirements and prioritizing security. On the other hand, white-label solutions offer a faster time-to-market and reduced development costs.

- Secondly, expertise plays a pivotal role in selecting a development partner. It is essential to partner with a company that has a proven track record in building secure and stable crypto exchanges. The development partner should possess in-depth knowledge of the latest industry trends and technologies, ensuring the exchange is built to withstand market volatility.

- Transparency is another critical factor. Clear communication channels, transparent pricing models, and a commitment to transparency throughout the development process are indicators of a reliable development partner. Traders should prioritize partnerships with companies that promote open collaboration, providing a clear understanding of the development journey.

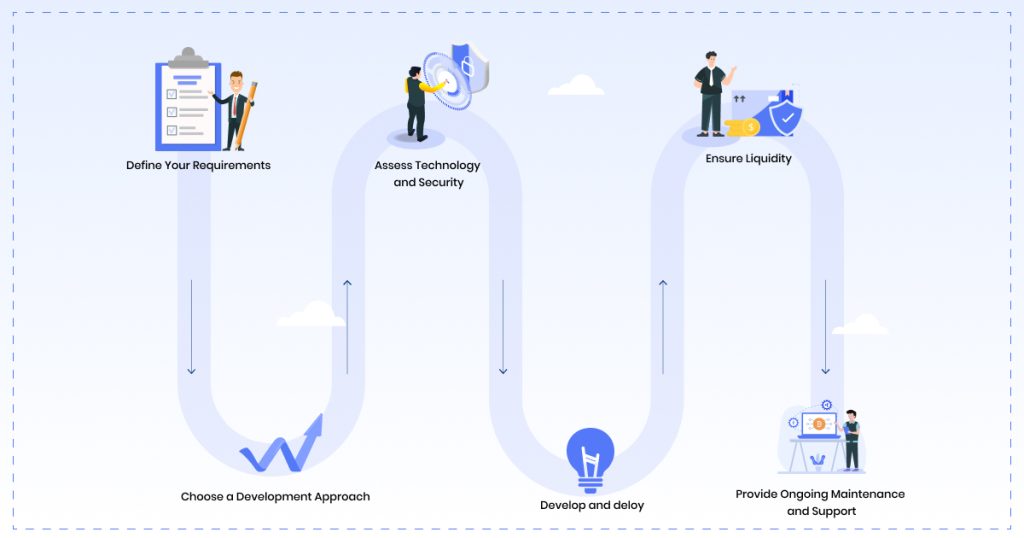

Steps for Building a Crypto Exchange:

- Define Your Requirements: Determine the specific features and functionalities you want your crypto exchange to have. Consider factors such as the types of cryptocurrencies supported, trading pairs, security measures, user interface, and trading tools.

- Choose a Development Approach: Decide between custom development and utilizing a white-label solution. Custom development offers flexibility and customization options, while a white-label solution provides a faster time-to-market.

- Assess Technology and Security: Select the appropriate technology stack for your crypto exchange, including the backend infrastructure, trading engine, user authentication, and API integration. Implement robust security measures, such as encryption, two-factor authentication, and cold storage for funds.

- Develop and Deploy:

- 1. Work closely with your development team to build the crypto exchange according to your defined requirements.

- 2. Perform thorough testing to ensure a secure and stable platform.

- 3. Deploy the exchange on a reliable hosting provider.

- Obtain Legal and Regulatory Compliance: Research and comply with the legal and regulatory requirements of the jurisdictions in which you plan to operate. This includes obtaining necessary licenses and implementing proper KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures.

- Ensure Liquidity: Establish partnerships with liquidity providers to ensure sufficient liquidity in your crypto exchange. This allows for smooth trading experiences and avoids liquidity bottlenecks.

- Provide Ongoing Maintenance and Support: Continuously monitor and update your exchange to address any potential security vulnerabilities or performance issues. Offer responsive customer support to assist users and handle their inquiries or concerns.

We Mobile App Development Company in Chennai, India – Pyramidions

The Importance of Mobile Apps for Blockchain Development

Mobile apps play a crucial role in blockchain development by providing seamless access and interaction with blockchain platforms from any location. They enhance user experience through intuitive interfaces and real-time updates, making complex blockchain processes more manageable. Additionally, mobile apps ensure robust security measures to protect digital assets and transactions, fostering greater trust and engagement in blockchain technology.

Accessibility and Convenience

Mobile apps are crucial for blockchain development, providing unparalleled accessibility and convenience for users to engage with blockchain platforms anytime, anywhere.

Enhanced User Experience

As a Mobile App Development Company in Chennai, Pyramidions recognizes the transformative potential that mobile applications bring to the blockchain ecosystem. By enabling users to interact with blockchain networks seamlessly through their smartphones, mobile apps enhance user engagement and participation significantly.

Simplified Interaction

Mobile apps offer intuitive interfaces, simplified navigation, and responsive designs that cater to both novice and experienced users’ needs. A well-designed mobile app can demystify complex blockchain processes, making it easier for users to understand and utilize blockchain services effectively.

Checklist for Assessing a Development Partner:

- Expertise and Experience: Evaluate the development partner’s expertise in building crypto exchanges and their track record of success. Look for companies with experience in the industry and a deep understanding of the latest technologies.

- Security Measures: Ensure the development partner has a strong focus on security, implementing advanced encryption techniques, multi-signature wallets, and secure coding practices. Inquire about their security audits and protocols.

- Technology Stack: Assess the development partner’s chosen technology stack, ensuring it aligns with industry standards and supports the features and scalability required for your crypto exchange.

- Transparency and Communication:Seek a development partner who values transparency and maintains open lines of communication throughout the development process. Explicit pricing models and a well-defined development approach are indicators of a reliable partner.

- Support and Maintenance: Inquire about the development partner’s post-launch support and maintenance services. Prompt bug fixes, updates, and ongoing technical support are crucial for the long-term success of your crypto exchange.

By following these steps and considering the checklist when building your crypto exchange and selecting a development partner, you can ensure a smooth development process, a secure platform, and a positive user experience.

Unveiling Crypto Battering Tactics and Safeguarding Trader

Cryptocurrency exchanges play a crucial role in facilitating trading activities, but unfortunately, there are instances where some exchanges engage in practices that can be detrimental to traders. In this section, we will shed light on some tactics used by certain exchanges to batter traders and provide guidance on safeguarding their interests.

Unveiling Crypto Battering Tactics:

- Manipulative Market Making: Certain exchanges employ manipulative market-making techniques, artificially creating buy or sell pressures to influence prices. These tactics can cause rapid price fluctuations, making it challenging for traders to make informed decisions.

- Front-Running: Some exchanges exploit their access to traders’ orders by executing trades ahead of them, taking advantage of price movements to profit at the expense of their users. This unfair practice creates an uneven playing field for traders.

- Insider Trading: In instances where exchanges have access to private information about upcoming listings or developments, they may engage in insider trading by capitalizing on this information before publicly disclosing it. This unethical behavior can lead to significant losses for traders.

Safeguarding Traders:

- Research and Reputation: Before using an exchange, conduct thorough research on its reputation, security measures, and user reviews. Trusted exchanges with a track record of reliability and transparency are more likely to prioritize the interests of their traders.

- Regulation Compliance: Choose exchanges that adhere to regulatory requirements and demonstrate a commitment to compliance. Regulated exchanges are subject to oversight and are more likely to follow ethical practices.

- Secure Wallets: To protect funds, practice safe storage of cryptocurrencies. Use hardware wallets or secure software wallets with strong encryption to safeguard your digital assets.

- Two-Factor Authentication (2FA): Enable 2FA on your exchange accounts to provide an additional layer of security and protect against unauthorized access.

- Understand Trading Fees: Be aware of the fee structures and trading costs associated with an exchange. High trading fees can significantly impact profitability, especially for frequent traders.

- Independent Research and Analysis: Rely on reputable sources of information and perform independent research and analysis before making trading decisions. Stay updated on market trends, news, and developments that may impact your investments.

By being vigilant, conducting due diligence, and implementing robust security measures, traders can protect themselves from exchanges engaging in crypto battering tactics.

Choosing reputable exchanges that prioritize transparency, regulatory compliance, and fair trading practices is essential for the long-term success and security of traders.

Wrapping Up:

In the fast paced world of cryptocurrency trading, success requires a reliable and innovative partner. Look no further than Pyramidions, the trusted leader in developing secure and cutting-edge crypto exchanges.

With our proven expertise and focus on security, Pyramidions empowers traders to navigate the complexities of the crypto landscape and position themselves as industry leaders. Take advantage of the opportunity to partner with us.

Ready to turn your crypto exchange vision into a reality? Contact Pyramidions today to discuss your development needs and receive a personalized quote. Unlock the potential of your crypto exchange with Pyramidions’ unrivaled technical prowess and commitment to excellence.

Empower yourself with Pyramidions’ cutting-edge solutions and exceptional support. Together, we will create a secure and high-performing trading platform that sets you apart in the competitive crypto market.

Having almost 10 years hands-on experience in technologies like Blockchain, Quantum security, Architecting Scalable Systems, Microservices, Metaverse, Data Science and Mobile-oriented technologies, it is also my nature to infuse some fun-filled activities aiming to optimize team communication and productivity.