Are you curious about how to start a crypto exchange? Imagine yourself as the architect of a digital marketplace, where the pulse of the future’s currency beats. Cryptocurrency exchanges, developed by Cryptocurrency Exchange Development Companies, are the epicenter of this financial evolution, rapidly defining how we understand money.

Before laying the digital bricks for your own exchange, apprehend the cryptocurrency whirlwind—its fluctuations, surges, and the keen interests propelling the ascent of digital assets. Delving into a sector that boasts exceptional growth potential requires thorough research, meticulous planning, and a clear vision.

In this guide, we’ll explore the steps to build a cryptocurrency exchange like Binance, Coinbase, KuCoin, or WazirX. These platforms represent the forefront of the digital currency revolution, each with unique features and offerings shaping the landscape of finance.

How to Start a Crypto Exchange by Understanding Crypto Space

What is a crypto exchange?

A cryptocurrency exchange is a digital platform that facilitates the buying, selling, and trading of various cryptocurrencies. It acts as a marketplace where users can exchange one type of virtual currency for another or convert cryptocurrencies into traditional fiat money like INR, USD or EUR.

Types of Cryptocurrency Exchanges

There are two primary types of cryptocurrency exchanges:

- Fiat-to-Crypto Exchanges

Fiat-to-crypto exchanges allow users to trade traditional fiat currencies (like INR,USD, EUR, etc.) for cryptocurrencies and vice versa. For instance, users can buy Bitcoin using their credit card or bank transfer, and they can also sell Bitcoin to receive fiat currency deposited into their bank account.

- Crypto-to-Crypto Exchanges

Crypto-to-crypto exchanges enable users to trade one cryptocurrency for another. For example, users can exchange Ethereum for Bitcoin or swap any supported cryptocurrencies within the platform.

Here’s a comparison table highlighting the key differences between Centralized Exchanges (CEXs) and Decentralized Exchanges (DEXs) from a development perspective:

| Aspect | Centralized Exchange (CEX) | Decentralized Exchange (DEX) |

|---|---|---|

| Architecture | Monolithic architecture | Typically uses modular or microservices architecture |

| Control and Ownership | Controlled by a centralized entity (exchange operator) | Operated by smart contracts on a decentralized network |

| Development Complexity | Generally simpler development process | More complex development due to decentralized nature |

| Smart Contracts | Minimal use of smart contracts for basic functionalities | Relies heavily on smart contracts for core functionalities |

| User Interface | Typically offers more user-friendly interfaces | Interfaces can be less intuitive due to technical nature |

| Security Model | Relies on centralized security measures (firewalls, etc.) | Leverages blockchain’s decentralized security mechanisms |

| Order Matching | Centralized order matching engine for faster processing | Utilizes on-chain order books or off-chain protocols |

| Scalability | Limited scalability due to centralized infrastructure | Potentially greater scalability using distributed systems |

| Listing Process | Controlled listing process by exchange operators | Allows direct token listing by users through smart contracts |

| Transaction Speed | Faster transaction processing due to centralized control | Slower transaction speed due to blockchain |

| Liquidity and Volume | Typically higher liquidity and trading volume | Lower liquidity and volume compared to major CEXs |

| Compliance and Regulation | Subject to regulatory compliance and oversight | Often operates in a more regulatory-ambiguous environment |

Popular Cryptocurrency Exchanges

Several popular cryptocurrency exchanges include:

- Binance

- Coinbase

- FTX

- Kraken

- KuCoin

These exchanges offer different services and support various cryptocurrencies. Each exchange has its unique features and limitations, such as withdrawal restrictions and supported trading pairs.

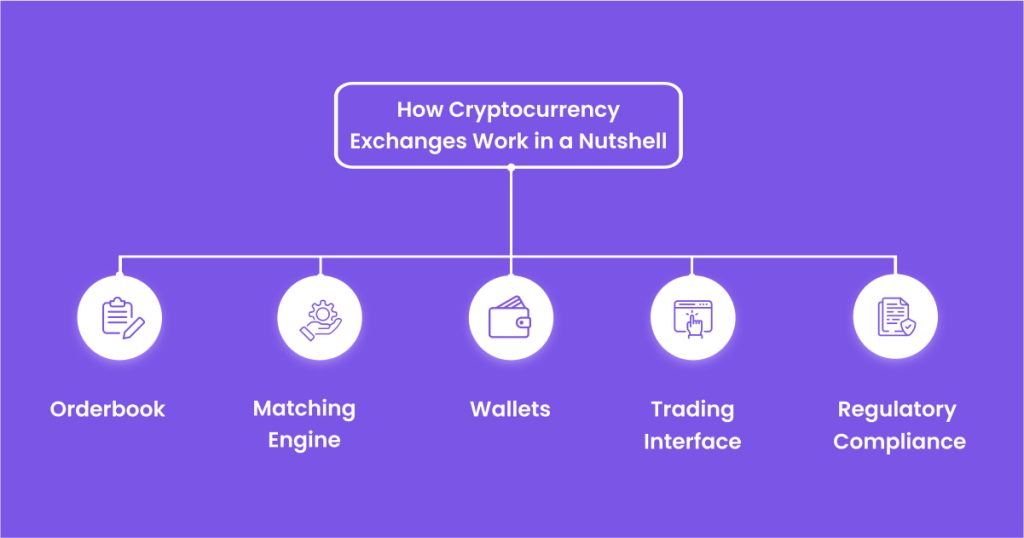

How Cryptocurrency Exchanges Work in a Nutshell

The functioning of a cryptocurrency exchange involves several key components:

- Order Book

The order book is a ledger that lists all buy and sell orders placed by users. It displays current market demand and supply for each cryptocurrency pair. - Matching Engine

The matching engine processes buy and sell orders from the order book. It matches buy orders with sell orders based on price and quantity, ensuring trades are executed efficiently. - Wallets

Cryptocurrency exchanges manage wallets to hold users’ funds securely. Each user has a unique wallet address associated with their account for depositing and withdrawing funds. - Trading Interface

The trading interface is a user-friendly platform where traders can view price charts, place orders, and monitor their portfolio. - Regulatory Compliance

Exchanges must adhere to legal and regulatory requirements in the jurisdictions they operate in, ensuring security and trustworthiness for users.

cryptocurrency exchanges play a pivotal role in the blockchain ecosystem by providing a platform for users to trade digital assets. They vary in terms of supported cryptocurrencies, features, and regulatory compliance, catering to a diverse global market of crypto enthusiasts and investors.

Tip: Focus on security, scalability, and compliance to build a robust Cryptocurrency Exchange Development Insights platform.

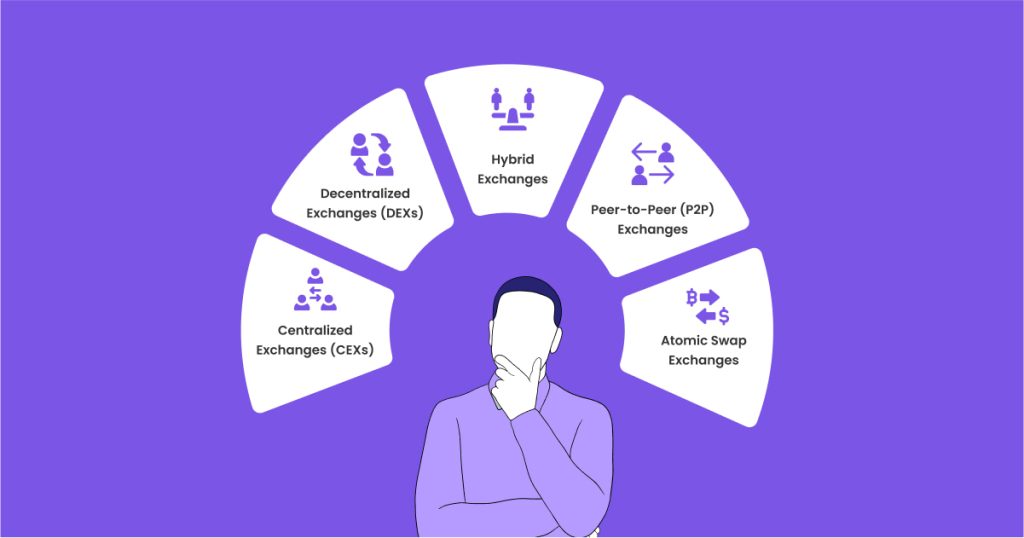

Types of Cryptocurrency Exchanges

Cryptocurrency exchanges serve as vital platforms for buying, selling, and trading digital assets. They come in various forms, each offering unique features and functionalities to cater to diverse user preferences within the evolving crypto landscape.

Before you think about how to start a crypto exchange, you must know the types of exchanges and decide which one suits your business best.

- Centralized Exchanges (CEXs)

Centralized exchanges operate as intermediaries between buyers and sellers, facilitating trades and holding user funds in centralized wallets. They typically offer high liquidity, a wide range of trading pairs, and user-friendly interfaces. Examples include Binance, Coinbase, and Kraken.

Key Features:

- Intermediary role with custody of user funds.

- High liquidity and a diverse selection of cryptocurrencies.

- Centralized order matching and customer support.

- Compliance with regulatory standards.

- Decentralized Exchanges (DEXs)

Decentralized exchanges operate on a peer-to-peer (P2P) network using smart contracts deployed on a blockchain. Users trade directly with each other without the need for a central authority, offering enhanced security and privacy. Notable DEXs include Uniswap, PancakeSwap, and SushiSwap.

Key Features:

- Direct peer-to-peer trading via smart contracts.

- Non-custodial nature with users retaining control of their funds.

- Increased privacy and censorship resistance.

- Lower fees compared to centralized exchanges.

Tip: Highlight reduced transaction costs and increased privacy for users in how Decentralized Exchanges Benefit Businesses.

- Hybrid Exchanges

Hybrid exchanges combine elements of both centralized and decentralized models, offering a balance between user-friendliness and security. They may leverage decentralized settlement layers while maintaining centralized order books and interfaces. Examples include Binance DEX and Huobi.

Key Features:

- User-friendly interface with decentralized settlement.

- Enhanced security through non-custodial features.

- Access to a wide range of trading pairs and liquidity.

- Compliance with regulatory requirements.

Less Common Types of Cryptocurrency Exchanges

- Peer-to-Peer (P2P) Exchanges

P2P exchanges facilitate direct trades between users without a central intermediary, similar to DEXs but potentially less automated. They connect buyers and sellers directly, allowing for flexible payment methods and local currency support. LocalBitcoins is a well-known P2P exchange platform.

Key Features:

- Direct interaction between buyers and sellers.

- Flexibility in trading methods and payment options.

- Emphasis on privacy and decentralized transactions.

Tip: Prioritize user-friendly interfaces and stringent credit checks to ensure trust and efficiency in P2P Lending Apps.

- Atomic Swap Exchanges

Atomic swap exchanges enable direct exchange of cryptocurrencies between different blockchains without the need for a third party. This relatively new concept allows for cross-chain interoperability and eliminates the reliance on centralized exchanges for token swaps.

Key Features:

- Cross-chain compatibility for direct asset swaps.

- Enhanced security and decentralization.

- Promotes interoperability between blockchain networks.

Understanding the various types of cryptocurrency exchanges is essential for traders and investors seeking to navigate the crypto market and choose platforms that align with their trading preferences, security requirements, and regulatory considerations.

How to Start a Cryptocurrency Exchange: The Best 4 Options

Launching a cryptocurrency exchange involves strategic decisions regarding development methods and platform setup. Explore various options beyond white-label solutions and custom development to make an informed business choice.

Utilizing a white-label crypto exchange solution provides a pre-built framework equipped with essential components for launching a cryptocurrency exchange. Here are the pros and cons:

Advantages:

- Faster Time to Market: Ready-to-deploy solutions reduce development time significantly, allowing for a quicker launch.

- Lower Development Cost: Initial investment is reduced as basic features and functionalities are pre-built.

- Instant Access to Basic Features: Includes trading engine, user interface, liquidity integration, and administrative tools.

Disadvantages:

- Reliance on Third-Party Provider: Dependency on the solution provider for updates, maintenance, and support.

- Limited Functionality & Customization: Restrictions on implementing unique features or extensive customization.

- Platform Scaling Challenges: Potential issues with scalability as the platform grows.

Tip: Opt for customizable, ready-to-launch solutions to save development time in White Label Cryptocurrency Wallets.

Opting for custom development involves building a cryptocurrency exchange from scratch, allowing full control over every aspect of the platform. Consider the following pros and cons:

Advantages:

- Independence from Third-Party Providers: Complete ownership and control over the exchange’s development, operations, and future.

- Unlimited Customization: Ability to implement unique features, tailor user experience, and design platform architecture according to specific requirements.

- Scalability: Custom solutions can be optimized for scalability, accommodating growth and increased user activity.

- Unique UX/UI Design: Freedom to create a distinctive and user-friendly interface.

Disadvantages:

- Longer Time to Market: Development from scratch typically requires more time for planning, design, and implementation.

- Higher Development Costs: Initial investment may be higher due to extensive development and testing requirements.

Tip: Select scripts with high security, scalability, and a user-friendly interface for successful deployment of a Bitcoin Exchange Script.

Secondary Options to Start a Crypto Exchange

- Open-Source Cryptocurrency Exchange Platforms

Consider utilizing open-source cryptocurrency exchange platforms like OpenDAX, Gekko, or Cryptrade. These platforms provide a foundation for building a customized exchange while offering flexibility and community support.

Advantages:

- Community Support: Access to a community of developers contributing to the platform’s improvement and security.

- Cost-Effective: Utilize open-source software without licensing fees, reducing initial development costs.

- Customization Options: Modify and extend the platform according to specific business requirements.

Disadvantages:

- Technical Complexity: Requires technical expertise to customize and maintain the open-source codebase.

- Security Risks: Open-source platforms may be vulnerable to security threats without proper maintenance and updates.

- Limited Support: Reliance on community forums and documentation for troubleshooting and support.

- Turnkey Exchange Solutions

Explore turnkey exchange solutions offered by specialized companies that provide comprehensive exchange development services. These solutions often include customizable features and ongoing support.

Advantages:

- Comprehensive Solutions: All-in-one packages covering development, deployment, and maintenance of the exchange.

- Tailored Features: Customize exchange features and design based on specific business requirements.

- Ongoing Support: Access to technical support and updates from the service provider.

Disadvantages:

- Vendor Lock-in: Dependency on the service provider for ongoing maintenance and updates.

- Cost Considerations: Initial investment and ongoing fees may vary depending on the service package.

Additional Considerations for Starting a Cryptocurrency Exchange

Beyond the primary options mentioned above, consider these factors when embarking on cryptocurrency exchange development:

- Regulatory Compliance: Ensure compliance with local regulations and obtain necessary licenses.

- Market Analysis: Conduct thorough market research to identify target audience, competition, and market trends.

- User Experience (UX): Prioritize intuitive design and user-friendly features to enhance customer satisfaction.

- Partnerships and Liquidity Providers: Establish partnerships with liquidity providers to ensure sufficient trading volume.

- Customer Support: Implement reliable customer support services to address user queries and issues promptly.

In summary, evaluate the various options available for starting a cryptocurrency exchange based on your business objectives, budget, timeline, and long-term vision. Choose a solution that aligns with your requirements and offers scalability, security, and regulatory compliance in the dynamic crypto industry.

Step-by-Step Process for How to Start a Crypto Exchange

Pre-launch Preparation:

- Obtain Legal Counsel:

Before diving into the development of your cryptocurrency exchange, it’s crucial to obtain legal counsel to ensure strict compliance with licensing requirements. Understanding the regulatory landscape and obtaining the necessary permits and licenses will lay a solid foundation for your exchange’s legality and credibility.

- Select Operating Countries:

Determining which countries to operate your exchange in is a strategic decision that involves assessing regulatory environments, market demand, and potential growth opportunities. This step is essential when considering how to start a crypto exchange to ensure alignment with local laws and regulations.

- Define Target Audience:

Conduct market research to thoroughly understand and define your target audience. By identifying the demographics, preferences, and needs of potential users, you can tailor your exchange’s features and marketing strategies effectively. This is a critical aspect of how to start a crypto exchange to ensure market relevance and user engagement.

- Secure Funding:

Securing funding is a critical step in the pre-launch phase of starting a cryptocurrency exchange. Adequate financial resources are necessary to support the development, testing, and launch of your exchange platform. Proper funding is integral to the process of how to start a crypto exchange and ensures the viability and sustainability of your project.

By meticulously addressing these preparatory aspects, you can establish a strong foundation for initiating the development and launch of your cryptocurrency exchange. Each step plays a pivotal role in ensuring compliance, market viability, and financial stability for your venture.

Development and Implementation:

- Choose Software Provider:

Finding a reputable cryptocurrency exchange software solution provider is essential for the successful development of your exchange platform. Evaluate potential providers based on their expertise, track record, security features, and scalability. The software provider will play a key role in realizing your vision for how to start a crypto exchange..

- Decide Exchange Type:

Decide on the type of exchange you want to establish—whether it’s centralized, decentralized, or hybrid. Each type has its own advantages and considerations regarding governance, security, and user experience. This decision is fundamental in shaping the technical architecture and operational model of your cryptocurrency exchange.

- Select Exchange Features:

Choose the specific cryptocurrency exchange features that align with your target audience’s needs and market trends. Key features may include user authentication, wallet integration, trading engine, order book, liquidity management, and regulatory compliance tools.

- Implement Security Measures:

Implement robust security measures to protect user assets and data against cyber threats and unauthorized access. This includes encryption protocols, multi-factor authentication, cold storage for funds, regular security audits, and compliance with industry standards. Security is paramount in starting a cryptocurrency exchange to build trust and confidence among users.

- Establish Liquidity Connections:

Connect your exchange with liquidity providers and other exchanges to ensure sufficient trading volume and market depth. Liquidity management is a critical aspect of how to start a crypto exchange for achieving competitive pricing and order execution.

- Partner with Payment Processors:

Collaborate with payment processors to enable seamless fiat-to-crypto transactions and withdrawals on your exchange. Integrating reliable and secure payment gateways enhances user experience and expands the market reach of your platform. Offering diverse payment options is essential for attracting and retaining users.

Tip: Ensure multi-currency support and top-notch security features for user confidence in a Crypto Wallet Development Company.

Launch and Operation:

Build a Professional Team:

Assemble a skilled and dedicated team of professionals including developers, legal experts, compliance officers, customer support staff, and marketing specialists. Starting a cryptocurrency exchange requires a multidisciplinary team to handle technical development, regulatory compliance, customer service, and business operations effectively.

Design Exchange Platform:

Create a user-friendly and secure exchange platform that meets the needs and expectations of your target audience. Invest in intuitive UX/UI design, responsive features, and robust security protocols to enhance usability and trust among users.

Initiate Exchange Development:

Begin the development and testing phase of your exchange platform, ensuring that all features and functionalities are implemented according to specifications. Conduct rigorous testing, debugging, and optimization to address any issues and ensure a smooth user experience upon launch.

Obtain Regulatory Approvals:

Obtain the necessary regulatory approvals and crypto trading licenses to operate your exchange legally within your chosen jurisdictions. Compliance with local and international regulations is essential for building trust with users and safeguarding against legal risks.

Beta Testing and Launch:

Conduct comprehensive beta testing to gather feedback and identify areas for improvement before the official launch. Address any issues or bugs identified during testing to ensure a stable and reliable platform. Plan a strategic and impactful launch to generate buzz and attract initial users to your exchange.

Implement Marketing Strategy:

Develop and execute a comprehensive marketing and PR strategy to promote your exchange and acquire users. Leverage social media, content marketing, influencer partnerships, and targeted advertising to raise awareness and drive user adoption. Effective marketing is essential for the success of your exchange post-launch.

Provide Customer Support:

Offer dedicated customer support services to assist users with inquiries, technical issues, and account-related matters. Establish multiple channels of communication, such as live chat, email support, and community forums, to provide prompt and responsive assistance to users.

Maintain Ongoing Compliance:

Continuously monitor and maintain legal and regulatory compliance post-launch to ensure ongoing operation and growth of your exchange. Stay updated on evolving regulations and industry standards to adapt and implement necessary changes. Regular audits and compliance checks are crucial for long-term success.

By following these launch and operation steps, you can successfully launch and operate a cryptocurrency exchange that meets industry standards and user expectations. Continuously iterate and improve your platform based on user feedback and market dynamics to stay competitive in the evolving crypto landscape.

Tip: Integrate seamless Binance Smart Chain support for diverse token management in a BEP20 Wallet.

How Much Does It Cost to Build a Crypto Exchange in 2025?

Building a cryptocurrency exchange involves various components and considerations that impact the overall cost. The cost can vary significantly based on factors such as the type of exchange (centralized or decentralized), features, development complexity, security requirements, regulatory compliance, and design preferences.

Let’s break down the key cost factors and estimate the expenses involved in the process of how to start a crypto exchange.

Cost Factors for Building a Crypto Exchange:

- Type of Exchange:

- Centralized Exchange (CEX): Typically requires less development effort initially, but ongoing maintenance and security costs can be higher due to centralized infrastructure and regulatory compliance.

- Decentralized Exchange (DEX): Involves more complex development using blockchain technology, smart contracts, and decentralized protocols, which may require higher upfront costs but can offer lower ongoing maintenance expenses.

- Development and Design:

- Frontend Development: Includes user interface (UI) design, user experience (UX) optimization, responsive design for web app development and mobile app development.

- Backend Development: Building the trading engine, order matching algorithms, API integration, wallet integration, and database management.

- Smart Contract Development (for DEX): Creating smart contracts for order settlement, asset custody, and decentralized governance.

- Security and Compliance:

- Security Measures: Implementing robust security protocols, encryption, multi-factor authentication, cold storage solutions, and regular security audits.

- Regulatory Compliance: Obtaining licenses, adhering to KYC/AML (Know Your Customer/Anti-Money Laundering) regulations, and ensuring legal compliance in target jurisdictions.

- Infrastructure and Technology:

- Cloud Hosting: Costs associated with hosting services on cloud platforms like AWS, Azure, or Google Cloud.

- Blockchain Integration: Costs related to blockchain network usage, transaction fees, and smart contract deployment (for DEX).

- Liquidity and Market Access:

- Liquidity Providers: Partnering with liquidity providers to ensure sufficient trading volume and market depth.

- Market Data Services: Accessing real-time market data feeds and APIs for accurate pricing and trading information.

Estimated Cost Breakdown for Crypto Exchange Development:

| Component | Estimated Cost Range |

|---|---|

| Frontend Development (Web App) | $10,000 – $20,000+ |

| Frontend Development (Mobile App) | $10,000 – $40,000+ |

| Backend Development | $10,000 – $30,000+ |

| Smart Contract Development (DEX) | $20,000 – $30,000+ |

| Security and Compliance | $50,000 – $100,000+ (annual upkeep) |

| Infrastructure and Hosting | $5,000 – $50,000+ (monthly expenses) |

| Liquidity Providers | Variable based on agreement terms |

Additional Considerations:

- Team Composition: Costs associated with hiring developers, designers, blockchain experts, legal advisors, and compliance officers.

- Third-Party Services: Costs for integrating third-party APIs, payment gateways, KYC/AML providers, and market data providers.

- Maintenance and Support: Ongoing expenses for platform updates, bug fixes, customer support, and regulatory compliance.

It’s essential to conduct thorough research, define project requirements, and work with experienced development partners to ensure a successful and cost-effective implementation of your crypto exchange venture.

Wrapping Up

Launching your own cryptocurrency exchange is a promising venture with significant potential. From legal compliance and funding to development and deployment, each step is essential for success.

Pyramidions specializes in crypto exchange development, offering tailored solutions to meet your unique requirements. Our team of experts is ready to assist you in realizing your vision and navigating the complexities of blockchain technology.

Ready to get started? Contact Pyramidions today to discuss how to start a crypto exchange for your project and take the first step towards establishing your presence in the cryptocurrency market by getting your free demo call and quote with our business analyst team.

Join forces with Pyramidions and unlock the potential of decentralized finance and digital assets.

Having almost 10 years hands-on experience in technologies like Blockchain, Quantum security, Architecting Scalable Systems, Microservices, Metaverse, Data Science and Mobile-oriented technologies, it is also my nature to infuse some fun-filled activities aiming to optimize team communication and productivity.